The Truth Behind the “One Big Beautiful Bill”

A comprehensive, fact-based analysis that exposes what’s real, what’s misleading—and why it matters.

Before we dive in, here’s the full text of the bill on Congress.gov—so you can explore it for yourself.

1. What the Bill Actually Includes

Tax Policy and Family Support

Makes Trump-era 2017 tax cuts permanent—including reductions on individual and corporate tax rates, Child Tax Credit, and small-business deductions.

Introduces tax-free tip income for many service workers, expanded overtime deductions, and a Newborn Savings Account ($500–$1,000 seeded funds).

Temporarily increases SALT caps and adds new deductions for seniors and commuters.

Defense & Immigration Funding

Adds an estimated $150 B for defense and another $150–175 B for immigration and border enforcement, including ICE and wall construction.

Social Safety Net Reductions

Implements strict work requirements, eligibility checks, state cost-sharing, and caps spending that will significantly impact Medicaid and SNAP.

Eliminates or weakens clean-energy tax credits, including those for electric vehicles and renewables.

2. What the Bill Doesn’t Do

Not universal—tax benefits favor higher earners, and safety net cuts disproportionately affect low-income families.

Not deficit-neutral—CBO estimates show it will increase the deficit by $2.8–3.3 trillion over the next decade .

Not healthcare expansion—explicitly reduces Medicaid/Medicare funding, risking coverage for millions.

Not empowering election manipulation—contains no language granting control over election timelines or federal election power.

Not pro-environment—it rolls back green-energy support from the Inflation Reduction Act

3. Conservative & Liberal Perspectives

Conservative/National View

The White House touts it as the “largest middle- and working-class tax cut in U.S. history” and a “Blue-Collar BOOM”—highlighting permanent business/individual tax certainty, expanded childcare & overtime breaks, and rural support.

Fox Business notes over $4.4 T in tax cuts over a decade, along with tip/overtime relief .

Progressive/Left-Leaning View

AP, Axios, Time, and The Guardian report projected losses of 11–12 M uninsured, 3–8 M losing SNAP, $3.3 T deficit increase, and elimination of green-energy incentives.

Center for American Progress labels it “$1 T in Medicaid cuts paired with $1 T in tax giveaways for the richest 1%”.

Nonpartisan Analysis

CBO: projects 10.9 M losing health coverage and a $2.8 T increase in deficits.

Committee for a Responsible Federal Budget estimates $2.4 T added to deficit, rising to $3 T with interest, and potentially $5 T if temporary provisions extend.

KFF poll shows 64% public disapproval, with support only among MAGA Republicans—even they decline when told about hospital funding cuts or rising uninsured rates.

5. What GOP Supporters Emphasize

Tax certainty through permanent extension of cuts and deductions.

Targeted relief—especially for hourly workers, families, and communities benefiting from tip/shift/overtime exemptions.

Conservatives argue Medicaid and SNAP reforms correct dependency, and that states will prevent excessive negative impacts.

6. What Critics Warn

Coverage losses—up to 12 million more uninsured Americans.

Economic and public health consequences: rural hospital closures, job losses, higher mortality, poorer energy outcomes.

Massive deficit growth jeopardizes long-term fiscal health.

7. Impacts & Trade‑Offs

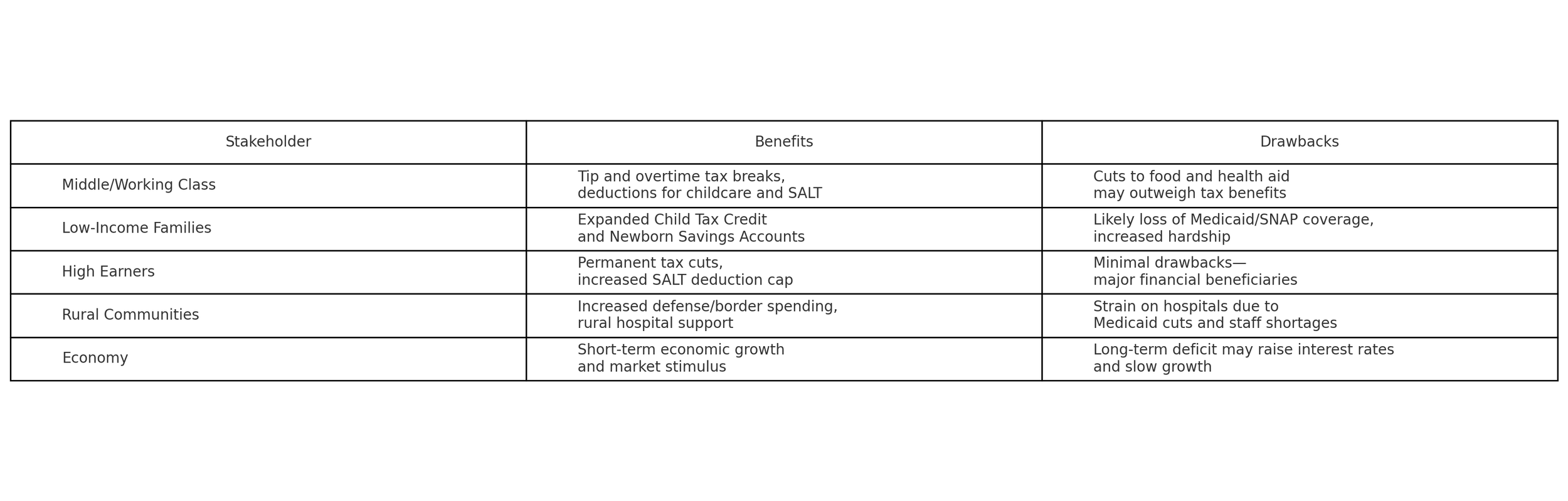

Figure: A visual summary of how different groups are impacted by the One Big Beautiful Bill—showing both the benefits and trade-offs.

Figure: A visual summary of the projected outcomes of the One Big Beautiful Bill. While it expands tax relief for working families and boosts border security funding, it also introduces significant cuts to Medicaid and SNAP, eliminates clean energy incentives, and increases the national deficit by an estimated $2.4–$2.8 trillion.

8. Why This Matters

This law isn’t black-and-white—it’s a bold realignment of federal priorities:

Short-term relief for many families and businesses.

Serious cuts to health and food support—risking coverage, hunger, economic stability.

Long-term fiscal strain—deficits projected to balloon by at least $3 T.

For Christians and civic-minded people, this is a moment to discern deeply:

Are the long-term harms to the vulnerable worth the short-term gains?

What kind of citizens do we want to be—those who advocate for the least among us, or those who celebrate gains for the few?

A Christian Perspective: Truth, Compassion, and Civic Responsibility

As believers, we’re not just voters, taxpayers, or political spectators—we’re ambassadors of Christ (2 Corinthians 5:20). Our faith should inform how we process laws, lead conversations, and protect the vulnerable. That includes how we respond to a bill like the One Big Beautiful Bill.

What Does Scripture Say?

Truth matters:

“You shall know the truth, and the truth will set you free.” (John 8:32)

We must be people who seek facts—not soundbites or spin. Let our opinions be shaped by wisdom, not just media narratives.

Justice matters:

“Speak up for those who cannot speak for themselves… defend the rights of the poor and needy.” (Proverbs 31:8–9)

Policies that impact healthcare, food security, and economic equity matter deeply to God—because they affect real people, especially the most vulnerable.

Love matters most:

“The entire law is fulfilled in keeping this one command: ‘Love your neighbor as yourself.’” (Galatians 5:14)

No matter where we stand politically, our response must be rooted in compassion and concern for our neighbors—not winning debates.

Final Reflection

The “Big Beautiful Bill” is neither a miracle cure nor total calamity. It’s a complex mix:

Real benefits: Lower taxes, especially for service and middle-class workers; greater certainty.

Serious trade-offs: Major reductions in social safety net programs—with real-world consequences for healthcare, hunger, and clean energy.

Fiscal risk: Adds trillions to the deficit with no broad agreement that economic growth will offset it.